Unpaid Leave Configuration

Unpaid leave configuration in MYOB Acumatica Payroll

Purpose

This information aims to help you configure your Pay Items and Entitlements effectively for processing employees who take Unpaid Leave. We will use Unpaid Parental Leave as an example, but keep in mind that this process can be applied to any type of Unpaid Leave.

Disclaimer: This information about how to use MYOB Advanced is of a generic nature and is based on information supplied by MYOB. Not to be relied on for legal, accounting or employment advice.

How to create an Unpaid Leave Entitlement

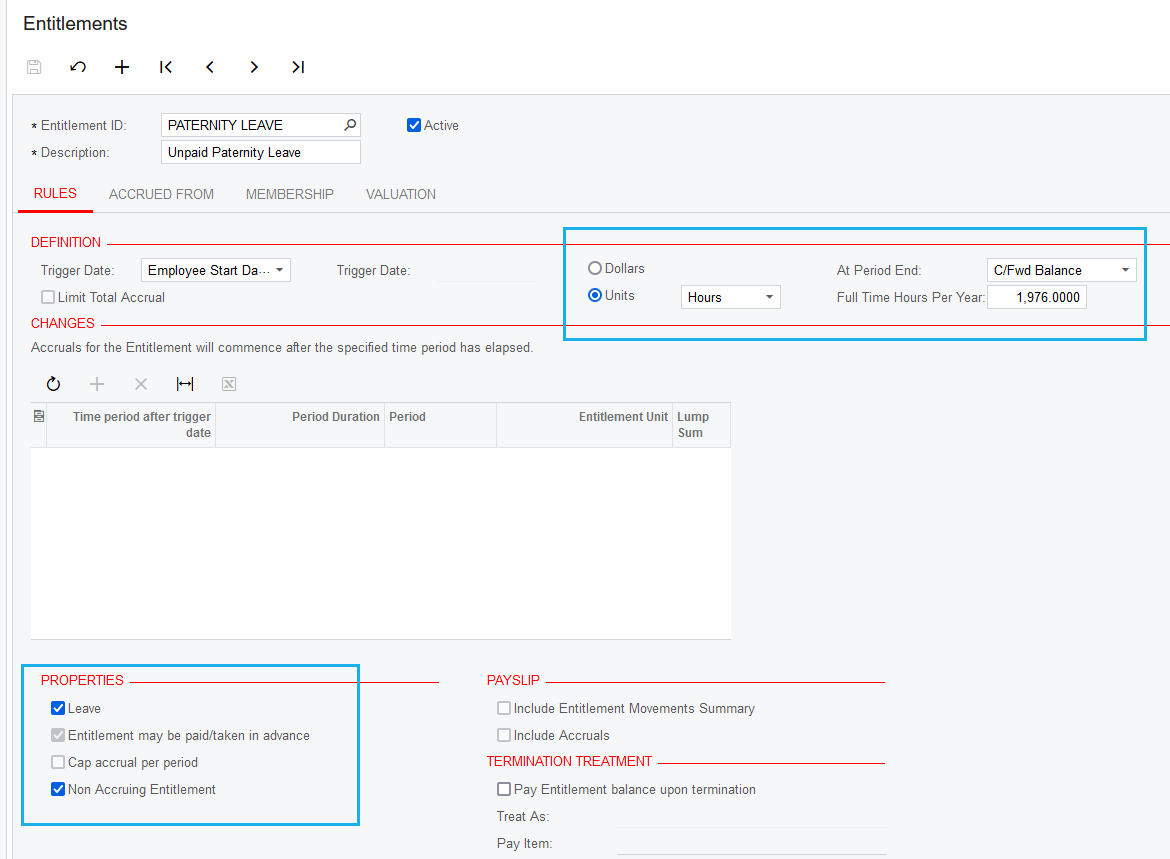

- To create a new Entitlement, go to the People/Payroll workspace and select Entitlements under Pay Item Configuration. Click on the plus symbol to add a new Entitlement. Provide an appropriate Entitlement ID and Description that accurately represents the type of leave.

- In the Definition section, an important step is to set the Units to Hours and the Full Time Hours per Year. To determine the Full Time Hours Per Year, multiply the number of hours in a Standard Work Week (usually 38 or 40) by 52 and enter that value in the field. Then, in the Properties section, select it as a Leave and indicate that it is a Non Accruing Entitlement.

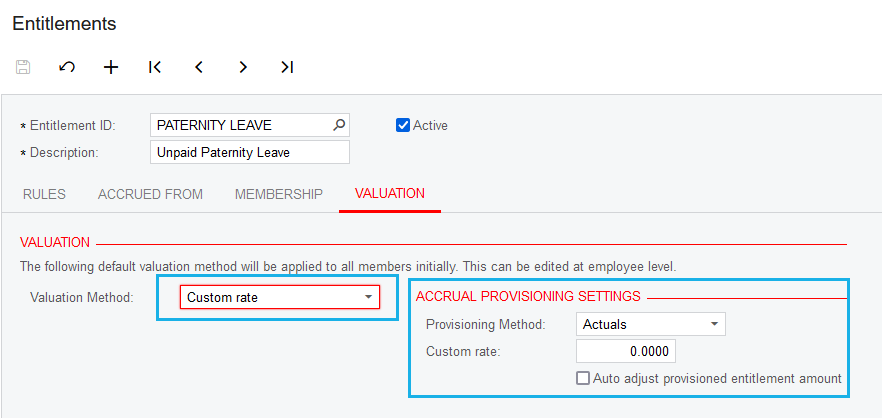

- After moving to the Valuation tab, go ahead and change the Valuation Method to Custom Rate. It's important to set the Custom Rate to zero in order to ensure that any values in this field will be reflected in the employee's Standard Pay. Don't forget to save your changes, and your entitlement should be properly set up.

-

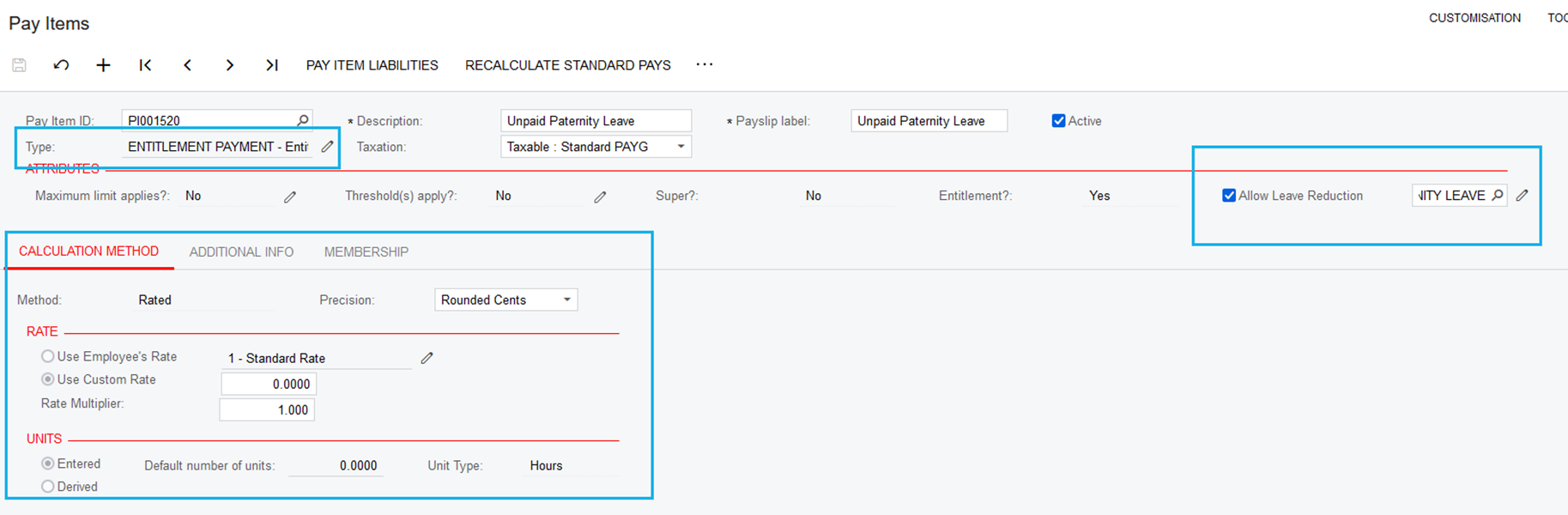

The next step is to create a Pay Item. To do this, navigate to the Pay Items section under Pay Item Configuration. When creating a new item, it is important to set the Type as Entitlement Payment. This will allow you to enable the "Allow Leave Reduction" option and link it to the Unpaid Leave Entitlement that you created in the previous steps. If you have correctly set the Valuation Method, the Calculation Method should automatically be set to zero.

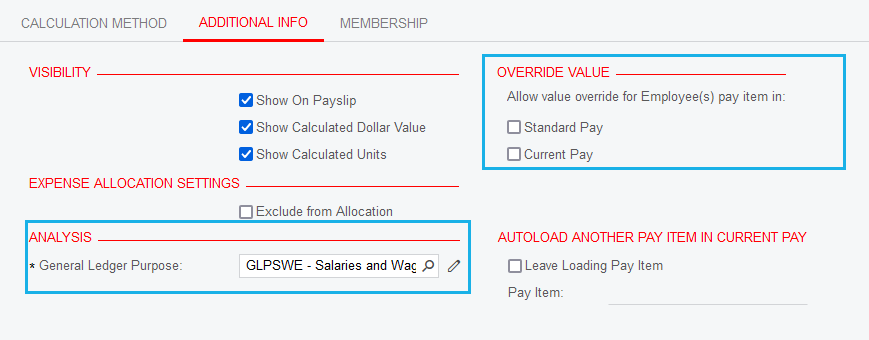

- To proceed, go to the Additional Info tab and select the General Ledger Purpose. For instance, in this scenario, I have chosen the Standard Salaries and Wages Expense. However, you have the option to set up a specific GL purpose code if desired. Remember to save your changes. Once completed, you will be able to effectively use the Pay Item and Entitlement in an employee's Standard Pay.

Questions?

If you have more questions, please contact BusinessHub's support desk on 1300 733 071 or raise a Support Case.